All Categories

Featured

Table of Contents

Some indexes have numerous variations that can weight parts or might track the impact of dividends in a different way. An index may influence your rate of interest attributed, you can not get, directly get involved in or obtain dividend payments from any of them through the plan Although an outside market index may affect your interest attributed, your plan does not directly participate in any kind of supply or equity or bond investments.

This web content does not apply in the state of New York. Warranties are backed by the financial stamina and claims-paying capacity of Allianz Life insurance policy Business of North America. Products are released by Allianz Life Insurance Coverage Firm of The United States And Canada, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. .

The details and summaries included right here are not planned to be complete descriptions of all terms, problems and exclusions applicable to the products and services. The specific insurance protection under any kind of nation Investors insurance coverage item goes through the terms, conditions and exclusions in the real policies as issued. Products and solutions explained in this site differ from one state to another and not all products, insurance coverages or services are readily available in all states.

FOR FINANCIAL PROFESSIONALS We've designed to provide you with the most effective online experience. Your current internet browser could restrict that experience. You may be using an old web browser that's in need of support, or settings within your browser that are not compatible with our website. Please save yourself some irritation, and upgrade your browser in order to watch our website.

Already utilizing an updated web browser and still having problem? Please give us a phone call at for further aid. Your existing web browser: Discovering ...

That's not the exact same as spending. So, beware of that. They will not just want you to buy the item, they desire you to go into business with them, join their team. Well, right here's a sign of things to come. Ask on your own, has he or she that's offering this item to me been doing this for five years or at the very least ten thousand hours' well worth of solutions? If the response is no, after that you are possibly on their listing of a hundred to three hundred individuals that they had to write down that are family and friends that they're now pitching within their network circle.

Cost Universal Life Insurance

I desire you to be a professional, a master of all the knowledge needed to be a success. Do not, Manny, if you do this, do not call a close friend or household for the very first five years. And after that, incidentally, you intend to inquire that in the interview.

I imply, that's when I was twenty-something-year-old Brian being in his financing class, and I was browsing, going, 'What do these individuals do after they finish?' And all of them go help broker-dealers or insurer, and they're offering insurance. I conformed to public audit, and currently I'm all excited because every parent is normally a certified public accountant that has a child in this evening.

That's where knowledge, that's where knowledge, that's where know-how comes from, not simply since somebody loves you, and currently you're gon na go turn them into a client. For additional information, take a look at our free sources.

I indicate, I am a financial solutions professional that cut her teeth on entire life, but that would embrace this theory focused around buying only term life insurance policy? Granted, term is an economical type of life insurance coverage, yet it is additionally a short-lived kind of protection (10, 20, 30 years max!).

It ensures that you live insurance beyond three decades despite how much time you live, actually and relying on the kind of insurance policy, your costs quantity might never ever change (unlike renewable term plans). After that there is that whole "invest the difference" thing. It truly massages me the wrong method.

Accumulation Value In Life Insurance

Keep it actual. If for nothing else reason than the truth that Americans are dreadful at conserving cash, "purchase term and spend the difference" ought to be outlawed from our vocabularies. Be patient while I drop some expertise on this point: According to the United State Social Security Management, the typical American's annual wage was $42,979.61 in 2011; Yet, only 14.6 percent of American families had liquid properties of $50,000 or even more during that same duration; That means that much less than 1 in 4 family members would certainly have the ability to change one income-earner's earnings must they be out of work for a year.

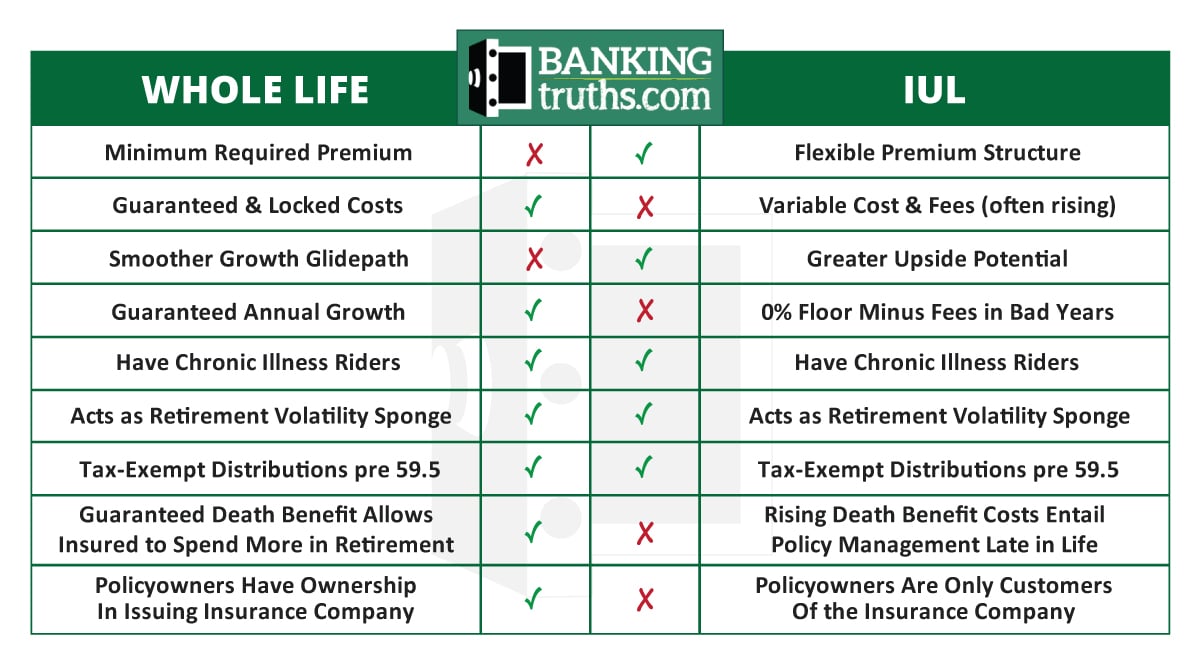

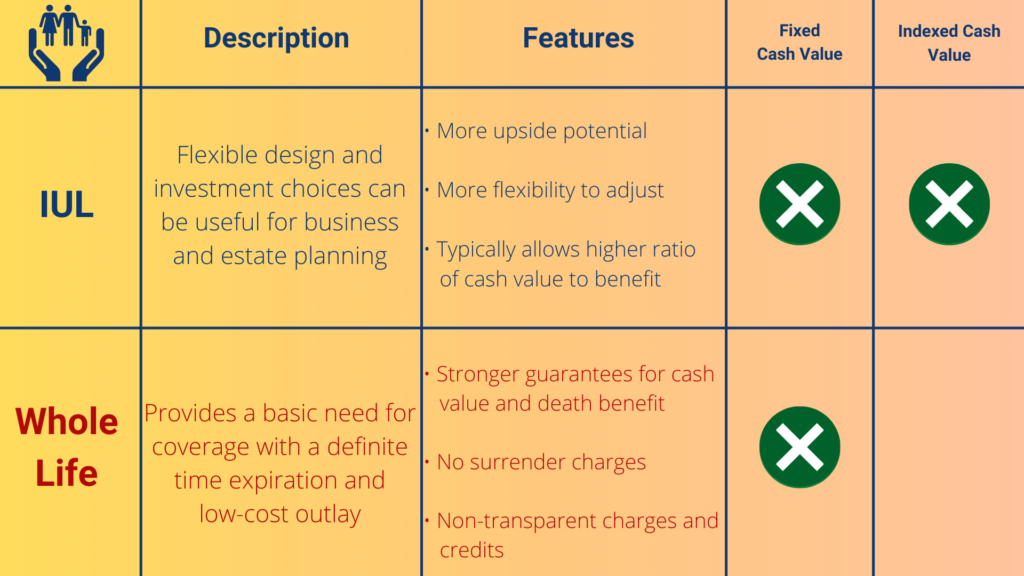

Suppose I informed you that there was a product that could help Americans to acquire term and invest the difference, all with a solitary purchase? Right here is where I get just downright kooky. Enjoy closelyHave you ever before examined how indexed global life (IUL) insurance technically functions? It is a kind of cash money value life insurance policy that has a flexible premium repayment system where you can pay as long as you want to develop up the cash money worth of your plan more swiftly (based on specific limits DEFRA, MEC, TEFRA, etc).

That's not the same as investing. Be careful of that. They will not just want you to buy the item, they want you to go right into business with them, join their group. Well, right here's a sign of things to come. Ask yourself, has he or she that's selling this product to me been doing this for 5 years or a minimum of 10 thousand hours' well worth of solutions? If the response is no, then you are probably on their checklist of a hundred to three hundred people that they needed to create down that are family and friends that they're currently pitching within their network circle.

Transamerica Index Universal Life Insurance

I desire you to be a professional, a master of all the expertise required to be a success. Do not, Manny, if you do this, do not call a pal or family members for the first 5 years (net payment cost index life insurance). And after that, by the way, you wish to ask that in the interview

I imply, that's when I was twenty-something-year-old Brian sitting in his finance class, and I was browsing, going, 'What do these people do after they graduate?' And all of them go work for broker-dealers or insurer, and they're marketing insurance coverage. I conformed to public bookkeeping, and currently I'm all excited since every parent is typically a CPA that has a youngster in this evening.

That's where knowledge, that's where knowledge, that's where knowledge comes from, not even if somebody likes you, and currently you're gon na go transform them into a client. For more details, look into our cost-free sources.

For as lengthy as I have actually been handling my own financial resources, I have actually been listening to that people should "buy term and spend the difference." I have actually never actually taken stock in the idea. I indicate, I am an economic solutions specialist that reduced her teeth on entire life, but who would embrace this theory focused around purchasing only term life insurance policy? Given, term is an inexpensive kind of life insurance policy, however it is also a short-lived sort of protection (10, 20, 30 years max!).

It makes certain that you live insurance coverage beyond 30 years no matter exactly how long you live, as a matter of fact and depending on the kind of insurance, your costs amount may never ever change (unlike eco-friendly term policies). After that there is that entire "invest the distinction" point. It truly rubs me the wrong method.

Declared Rate Universal Life Insurance

Maintain it actual. If for nothing else factor than the reality that Americans are horrible at conserving money, "acquire term and invest the distinction" ought to be outlawed from our vocabularies. Hold your horses while I go down some knowledge on this point: According to the United State Social Safety And Security Administration, the ordinary American's annual wage was $42,979.61 in 2011; Yet, just 14.6 percent of American family members had fluid properties of $50,000 or even more throughout that exact same duration; That indicates that much less than 1 in 4 families would have the ability to replace one income-earner's wages need to they be unemployed for a year.

What happens if I informed you that there was a product that could assist Americans to get term and spend the difference, all with a single purchase? Here is where I get simply downright kooky. Watch closelyHave you ever before researched just how indexed universal life (IUL) insurance coverage practically works? It is a sort of money value life insurance coverage that has an adaptable costs repayment system where you can pay as much as you want to accumulate the money value of your plan more swiftly (subject to specific restrictions DEFRA, MEC, TEFRA, and so on).

Latest Posts

Iul Insurance Meaning

Net Payment Cost Index Life Insurance

Universal Life Insurance Vs Term Life